Book Appointment Now

MSME & Government Schemes Every Small Contractor Should Know

Running a small construction business in India is not easy.

Small contractors deal with irregular payments, rising material costs, labour issues, and limited access to capital.

What many contractors don’t know is this:

👉 The government already has schemes meant exactly for you.

If you are a small contractor, civil contractor, labour contractor, or construction business owner, this guide will help you understand government schemes for contractors and MSME schemes for construction businesses—in simple words.

Why Government Schemes Matter for Small Contractors

Most small contractors operate informally. Because of this, they miss out on:

- Cheap government loans

- Subsidies

- Insurance and protection

- Priority in government projects

Government schemes exist to reduce risk, improve cash flow, and help small businesses grow—but only if you know about them and register properly.

MSME Registration — The Foundation for All Benefits

Before applying for most benefits, you must register as an MSME.

MSME stands for Micro, Small, and Medium Enterprises. Construction contractors are fully eligible.

Benefits of MSME Registration

- Access to government loans for construction business

- Protection against delayed payments

- Lower interest rates

- Eligibility for subsidies and tenders

MSME registration is free, online, and based on Aadhaar.

Without MSME registration, most contractor benefits under government schemes are not available.

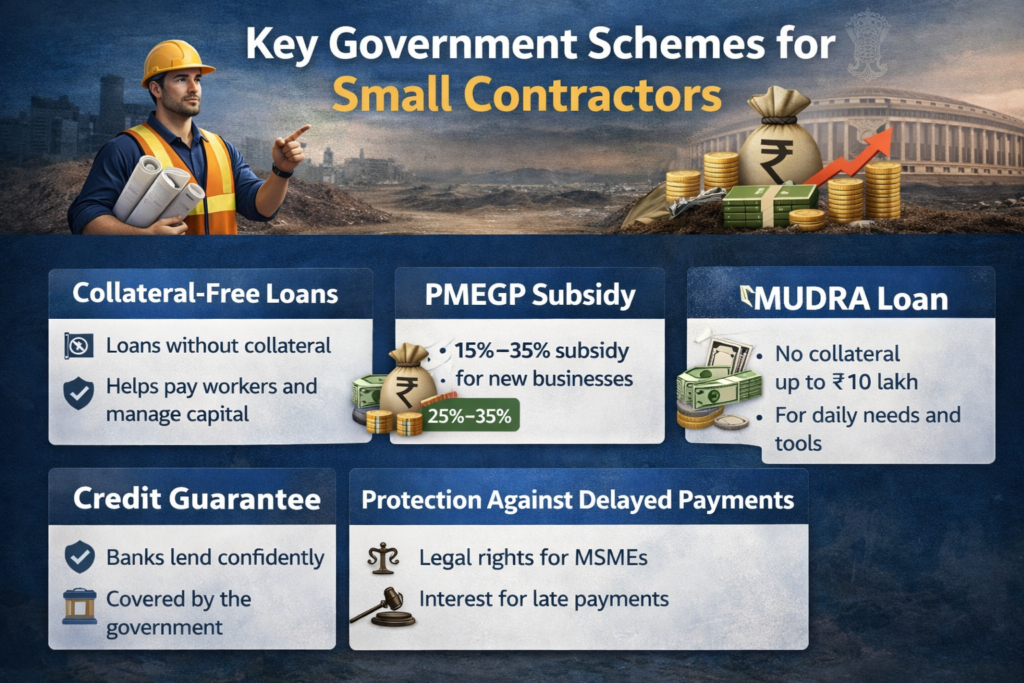

Key Government Schemes for Small Contractors

1. Collateral-Free Loans for Contractors

Many small contractors think banks will never give them loans. That’s not fully true.

Under government support programs, banks provide collateral-free loans to MSME-registered businesses.

Who benefits?

- Small construction firms

- Labour contractors

- First-time business owners

These loans help with:

- Buying tools and equipment

- Paying workers on time

- Managing working capital

This is one of the most useful government loans for construction business owners.

2. PMEGP – Subsidy for New Contractors

If you are starting a new construction or contracting business, this scheme is important.

PMEGP (Prime Minister’s Employment Generation Programme) provides subsidies for small contractors.

What you get:

- Government subsidy on project cost

- Lower loan burden

- Support for self-employment

Subsidy can range from 15% to 35%, depending on category and location.

This is often considered one of the best government schemes for small contractors in India who are just starting out.

3. MUDRA Loan for Small Contractors

MUDRA loans are designed for micro businesses, including construction contractors.

Types of MUDRA Loans:

- Shishu – up to ₹50,000

- Kishor – ₹50,000 to ₹5 lakh

- Tarun – ₹5 lakh to ₹10 lakh

No collateral is required.

Useful for:

- Daily operations

- Labour payments

- Small machinery and tools

This is one of the most accessible government schemes for contractors with limited paperwork.

4. Credit Guarantee Support for MSMEs

Many contractors don’t have property or assets to give as security.

Under the Credit Guarantee scheme, the government guarantees a portion of the loan taken by MSMEs.

This means:

- Banks are more willing to lend

- Contractors get loans without pressure

This scheme directly supports small construction businesses that struggle with trust and documentation.

5. Protection Against Delayed Payments

One major problem contractors face is delayed payment from clients.

MSME-registered contractors get legal protection:

- Buyers must pay within 45 days

- Interest is applicable on late payments

- Complaints can be filed online

This benefit alone makes MSME registration worth it.

Government Tenders & Priority Access

MSME contractors get:

- Fee exemptions in tenders

- Lower EMD (Earnest Money Deposit)

- Priority in government projects

This helps small contractors compete with bigger companies.

How Contractors Can Get Government Subsidies

Many contractors ask:

“How do contractors get government subsidies?”

Simple steps:

- Register as an MSME

- Maintain basic business records

- Apply through official portals or banks

- Choose schemes based on your business stage

You don’t need perfect paperwork—just basic discipline and consistency.

Common Mistakes Contractors Make

- Staying informal to avoid paperwork

- Depending only on cash transactions

- Not registering as MSME

- Ignoring government support

These mistakes keep contractors stuck at the same level for years.

Final Thoughts

India’s construction sector depends heavily on small contractors.

Yet most contractors are unaware of the very schemes created to support them.

Government schemes are not charity.

They are tools—meant to:

- Improve stability

- Reduce risk

- Support growth

If you are a contractor, MSME registration and awareness of government schemes can change your business future.

The system is imperfect—but ignoring it hurts only one side.